estate tax changes in reconciliation bill

In addition the draft proposes several significant and complex changes to the US international tax regime that will increase the taxes paid by most if not all US multinational companies. Effective January 1 2022.

Everything In The House Democrats Budget Bill The New York Times

As we write this commentary Congress and the White House are negotiating over proposed legislation which if enacted in its current form would significantly change tax laws that impact estate planning.

. This means the current inflation-adjusted exemption of 11700000 per person would be reduced to approximately. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. With inflation this may land somewhere around 6 million.

Under current law a 38 tax is imposed on Net Investment Income NII on certain individuals estates or trusts if a trade or business is a passive activity for the taxpayer ie the taxpayer does not materially. Estate and Gift Tax Changes Proposed. 13 released the draft text of their proposed tax-raising provisions which was the subject of a committee markup session two days later and has now been approved by the.

Current law provides that the individual estate and gift tax exemption will be reduced to 5000000 adjusted upwards each year for inflation in 2026. No Changes to the Current Gift and Estate Exemption Provisions Until 2025. Potential Tax Impact on Estate Planning.

Revised Build Back Better Bill Excludes Major Estate Tax Proposals. Reconciliation Bill has Significant Proposed Changes for Estate Gift and Income Taxes. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011.

The exemption will increase with inflation to approximately 12060000 per person in 2022. Under EGTRRA the 55 to 45. The House Ways and Means Committee proposal accelerates this reduction lowering the exemption amount to 6020000 after the.

Federal estate and gift tax are assessed at a flat rate of 40. Net Investment Income Tax Expanded 138203. The bills individual income payroll and estate tax provisions alone however would cut taxes on average for households making 500000 or less while still increasing them significantly for.

If enacted the Bill would among other things. In 2010 the estate tax was eliminated. In late October the House Rules Committee released a revised version of the proposed Build Back Better Act Reconciliation Bill.

Last week the House Ways and Means Committee released a draft of proposed tax law changes to include in a reconciliation bill. House of Representatives introduced a reconciliation bill that includes significant changes to estate gift and generation-skipping tax laws. Most of the major proposals that would create substantial changes in the estate planning arena were not included.

The 117M per person gift and estate tax exemption will remain in place and will be increased annually for inflation until its already scheduled to sunset at the end of 2025. The BBB bill does include some changes to income tax such as an additional taxes for large corporations and high-income individuals ie taxpayers with an adjusted gross income of more than 10. Growth and Tax Relief Reconciliation Act of 2001 EGTRRA.

Starting January 1 2026 the exemption will return to 549 million adjusted for inflation. As negotiations over spending and taxes in a potential budget reconciliation bill tentatively the Build Back Better Act are ongoing in Congress Democrats on the House Ways and Means Committee on Sept. 107-16 among other tax cuts provided for a gradual reduction and elimination of the estate tax.

This provision would generally be effective for. Appreciation on assets contributed to a grantor trust after date of enactment of the reconciliation bill will be pulled back into the. The estate tax exemption would be reduced as of January 1 2022 from its current 117 million to 5 million adjusted for inflation.

5376 the Bill proposes sweeping changes to tax rules that apply to individuals and trusts with far-reaching implications for estate planning. A 5 surtax on individual income in excess of 10 million per year with an additional 3 on income in excess of 25 million. Here are some changes the budget reconciliation tax law would bring about.

The latest proposals incorporated into the budget reconciliation bill commonly known as the Build Back Better Act. Instead it contains three primary changes affecting estate and gift taxes. While it is uncertain whether any of these proposals will be adopted.

The House budget reconciliation bill HR. The bill provides that taxpayers with AGI of 400000 or more and all trusts and estates would only be allowed to exclude 50 of the eligible gain. Effective January 1 2022 the lifetime federal estate and gift tax exclusions will be reduced from the current 117 million exemption to the 2010 level which would be approximately 6 million.

If a decedent dies in 2026 with an estate of 11700000 the exemption amount would. Eliminate estate and gift tax valuation discounts on interests in nonbusiness entities. There was general agreement that some sort of estate tax would be retained.

The Build Back Better Framework released by the White House made no mention of increases to the capital gains rate basic individual or corporate income tax rates or significant amendments to the estate and gift tax regime. The many changes floated since the presidential and congressional elections of 2020 would have reduced the amount that individuals could gift during lifetime or at death before application. The latest draft of the US Congress budget reconciliation Bill omits most of the previously proposed tax changes that would have affected US estate planning.

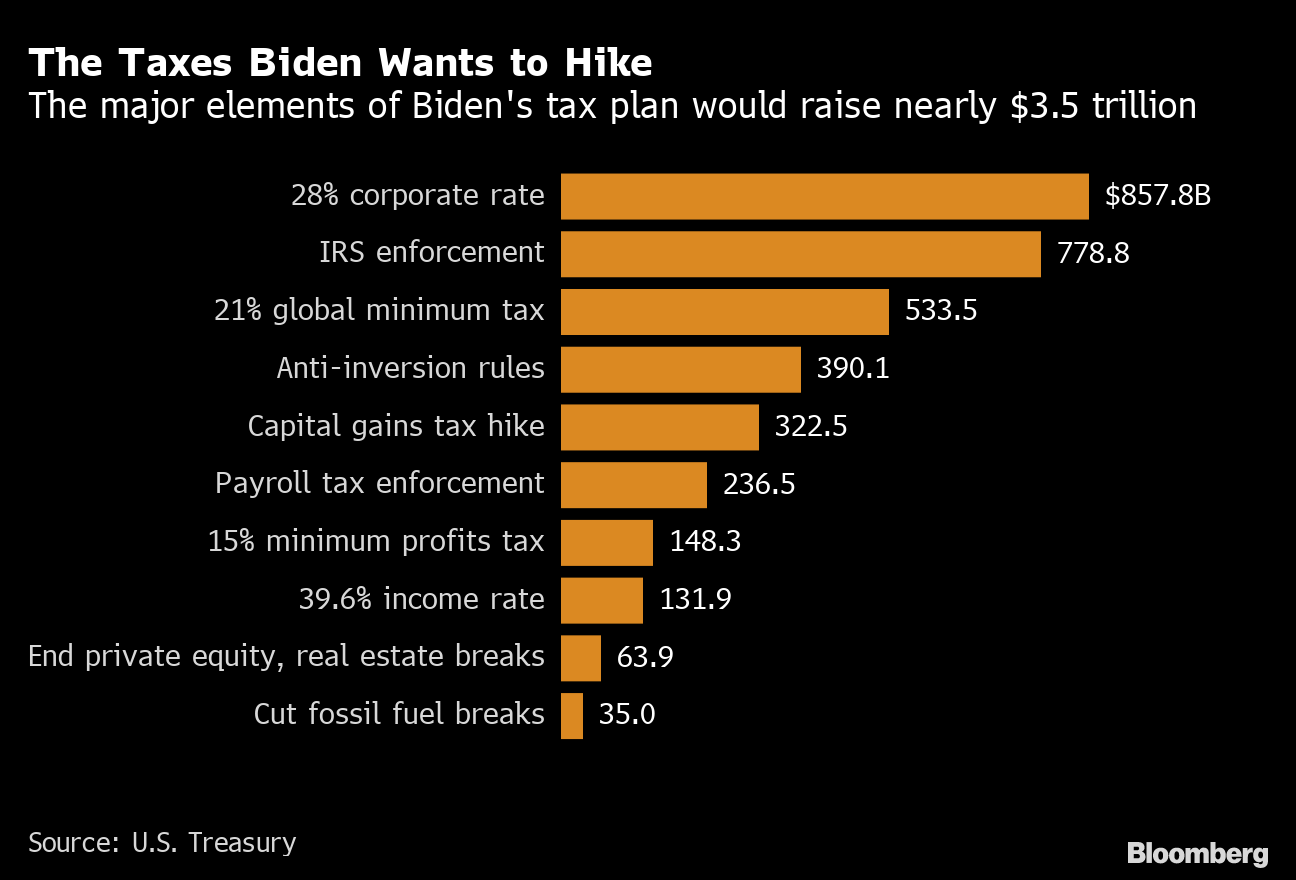

Learn more about the House Build Back Better Act including the latest details and analysis of the Biden tax increases and reconciliation bill tax proposals The House Build Back Better plan would result in an estimated net revenue increase of about 1 trillion 125000 fewer jobs and on average less after-tax incomes for the top 80 percent of. At the same time the bill would raise taxes substantially for those making 1 million or more according to a new analysis by the Tax Policy Center. The biggest headline for companies is 55 increase in the corporate tax rate from 21 percent to 265 percent for large businesses.

Estate and gift tax exemption. On September 27 the US.

New Taxes Will Hit America S Rich Old Loopholes Will Protect Them The Economist

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

How Rich Americans Plan To Escape Biden Tax Hikes Ppli Is A Perfect Loophole Bloomberg

Us Corporations Talk Green But Are Helping Derail Major Climate Bill Climate Policy Climates Corporate

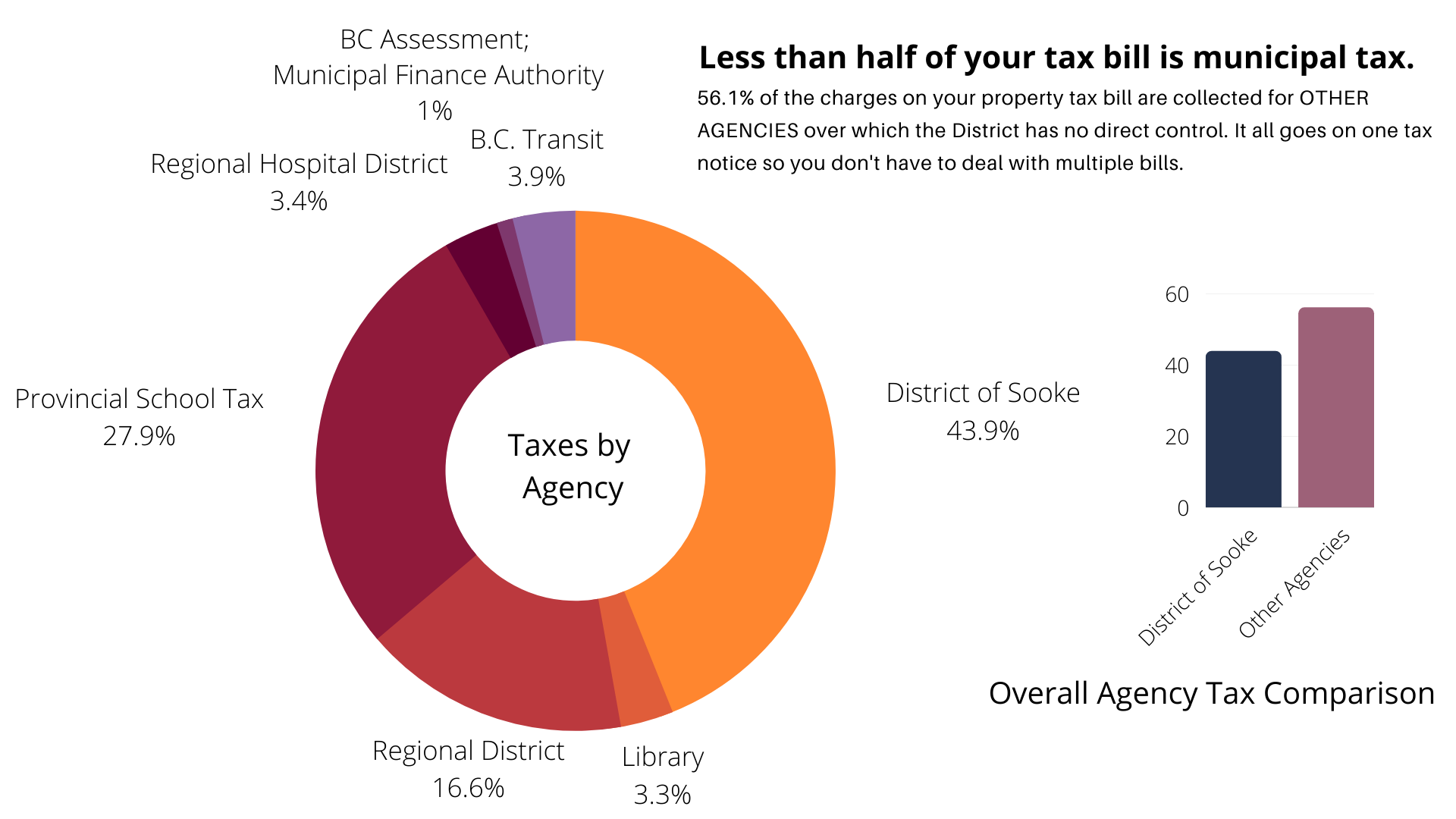

Paying Your Property Tax City Of Terrace

An Attempt To Understand Canada S Inheritance Tax Backlash Don Pittis Cbc News

Tax Proposals Under The Build Back Better Act Version 2 0

Will Trudeau S Reforms Really Mean 73 Tax For Small Business National Globalnews Ca

What Are Marriage Penalties And Bonuses Tax Policy Center

Property Taxes Town Of Gibsons

Everything In The House Democrats Budget Bill The New York Times

Tpc The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else

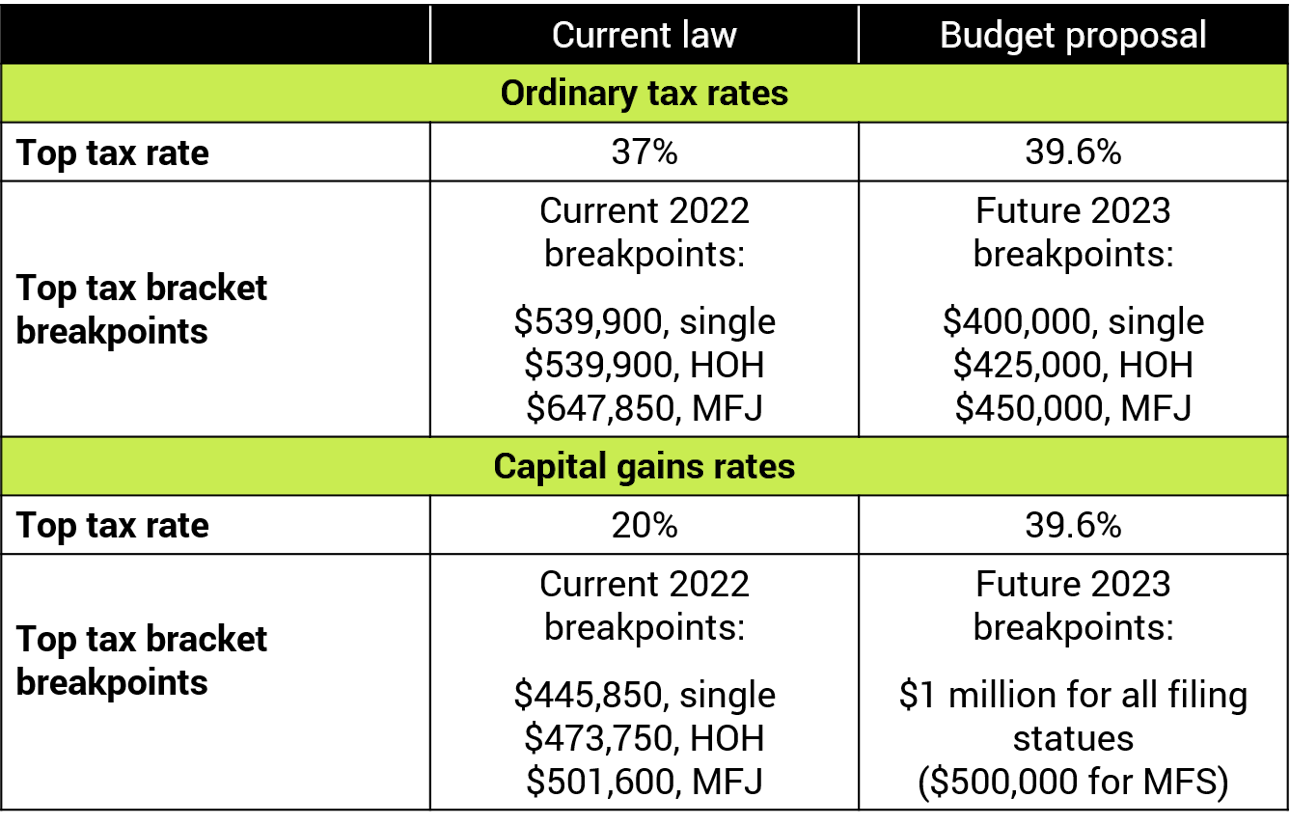

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

The Most Useful And Least Used Quickbooks Shortcuts Intuit News Invoice Templates For Quickbooks Invoice Template Create Invoice Quickbooks Online